All Categories

Featured

If you're mosting likely to utilize a small-cap index like the Russell 2000, you could desire to stop briefly and think about why an excellent index fund firm, like Vanguard, does not have any funds that follow it. The reason is since it's a lousy index. Not to state that changing your whole plan from one index to one more is hardly what I would call "rebalancing - maximum funded tax advantaged insurance contracts." Cash money value life insurance policy isn't an attractive asset course.

I have not also addressed the straw male here yet, and that is the reality that it is relatively uncommon that you actually have to pay either tax obligations or considerable payments to rebalance anyway. The majority of smart financiers rebalance as much as possible in their tax-protected accounts.

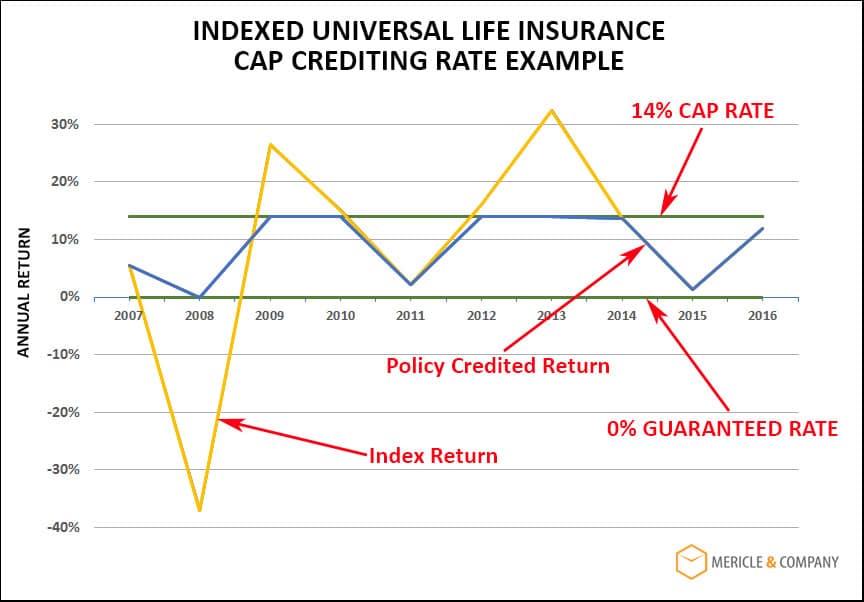

Universal Life Guaranteed Rate

Decumulators can do it by withdrawing from asset courses that have done well. And obviously, no one must be getting crammed shared funds, ever. Well, I really hope posts like these aid you to see with the sales strategies typically made use of by "financial specialists." It's actually regrettable that IULs don't work.

Latest Posts

Iul Insurance Pros And Cons

Allianz Iul

Why Indexed Universal Life Insurance Might Be New 401k